Build Equity as You Rent: How RPO’s Can Transform Your Vehicle Strategy

Fleet management is at a turning point—skyrocketing costs, fluctuating demands, and the need for adaptability are exposing cracks in traditional ownership models. Every idle truck, rigid contract, and inflexible decision is a missed opportunity to save money and grow.

For fleet managers ready to break free from these limitations, Rental Purchase Options (RPOs) are rewriting the playbook, empowering businesses to stay agile, control costs, and build long-term value.

What is a Rental Purchase Option (RPO)?

An RPO is an agreement that allows companies to rent vehicles while simultaneously building equity. Unlike traditional leases or lease-to-own options that impose rigid, long-term commitments, RPOs combine the flexibility and benefits of renting with the potential for ownership, making them an ideal choice for businesses managing shifting demand.

How Does an RPO Work?

- Flexible Rentals: Start by renting the vehicle for a specified period. During this time, you can use it for your business needs without a long-term commitment.

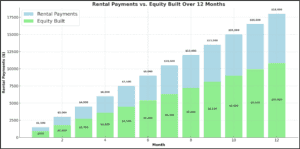

- Apply Rental Payments Toward Purchase: As you make your rental payments, a portion of those payments goes toward the vehicle’s purchase price. This means that the longer you rent, the more equity you build toward ownership.

- Purchase Option: Throughout the rental term, you have the option to procure the vehicle at a predetermined value, minus the rental credits accumulated during the rental period. If you decide not to buy, simply return the vehicle like a normal rental.

Benefits of an RPO

- Try Before You Buy: The RPO model allows you to evaluate new vehicles and upfit configurations in real-world conditions before making a permanent decision. This trial period can be invaluable for ensuring that the vehicle meets your specific needs.

- Cash Flow Friendly: Renting with an RPO helps manage monthly expenses without requiring a large upfront expenses. This flexibility can be a significant advantage for businesses looking to maintain cash flow.

- Build Ownership Equity: Your rental payments contribute toward potential ownership, allowing you to transition from renting to owning without the hassle of starting from scratch.

- No Long-Term Risk: If the vehicle doesn’t fit your needs, you aren’t locked into buying it. This alleviates the pressure of making a long-term commitment right away.

- Sidestep Capital Expenditure (CapEx) Budgets: Many organizations receive an annual allocation for fleet purchases. Once that budget runs out, they often still need vehicles. Renting, in general, is a great way to overcome this hurdle because rentals typically fall under operating expenses (OpEx), meaning they don’t count against the CapEx budget. An RPO takes this a step further—allowing businesses to rent in the short term to fill the need while still building equity. When the CapEx budget refreshes in the new year, they can execute the purchase option using their accumulated rental credits.

RPO Example:

Terms (Example): 60% RENTAL CREDIT in months 1-12, 40% RENTAL CREDIT in months 13-24

Building a Future-Ready Fleet Strategy

As fleet managers plan for the future, combining flexibility with fiscal responsibility is key. RPOs bridge the gap between immediate rental needs and the long-term advantages of ownership, empowering businesses to adapt quickly in a competitive market.

Whether expanding your fleet, experimenting with new vehicle types, or optimizing costs, the RPO model offers a versatile solution for your business’s unique needs. Embracing innovative strategies like RPOs can make all the difference in achieving operational success.

Have questions? Reach out to our team at (816) 673-3346 to learn more about RPOs and how they can benefit your organization!